Taxes Courses

All Subjects > Finance > Taxes

Learn about taxes, tax preparation, and personal finance. Take online tax courses on edX to build your skills, grow your business, and continue your tax education.

Related topics - Accounting | Actuarial Science | Corporate Finance | Economics | Finance | Government | Managerial Economics | Personal Finance | Public Economics | Public Policy

Why study taxes?

To pay taxes is a part of nearly every adult's life. Whether it's income tax, state tax and federal tax, or business tax, taxpayers must plan for these payments. The internal revenue service (IRS) keeps records and ensures that everyone who owes taxes pays them.

When everyone begins to work, they must learn to fill out income tax returns. Both individuals and businesses should understand tax filing to reduce the burden and to keep in compliance with government regulation.

Learn about taxes

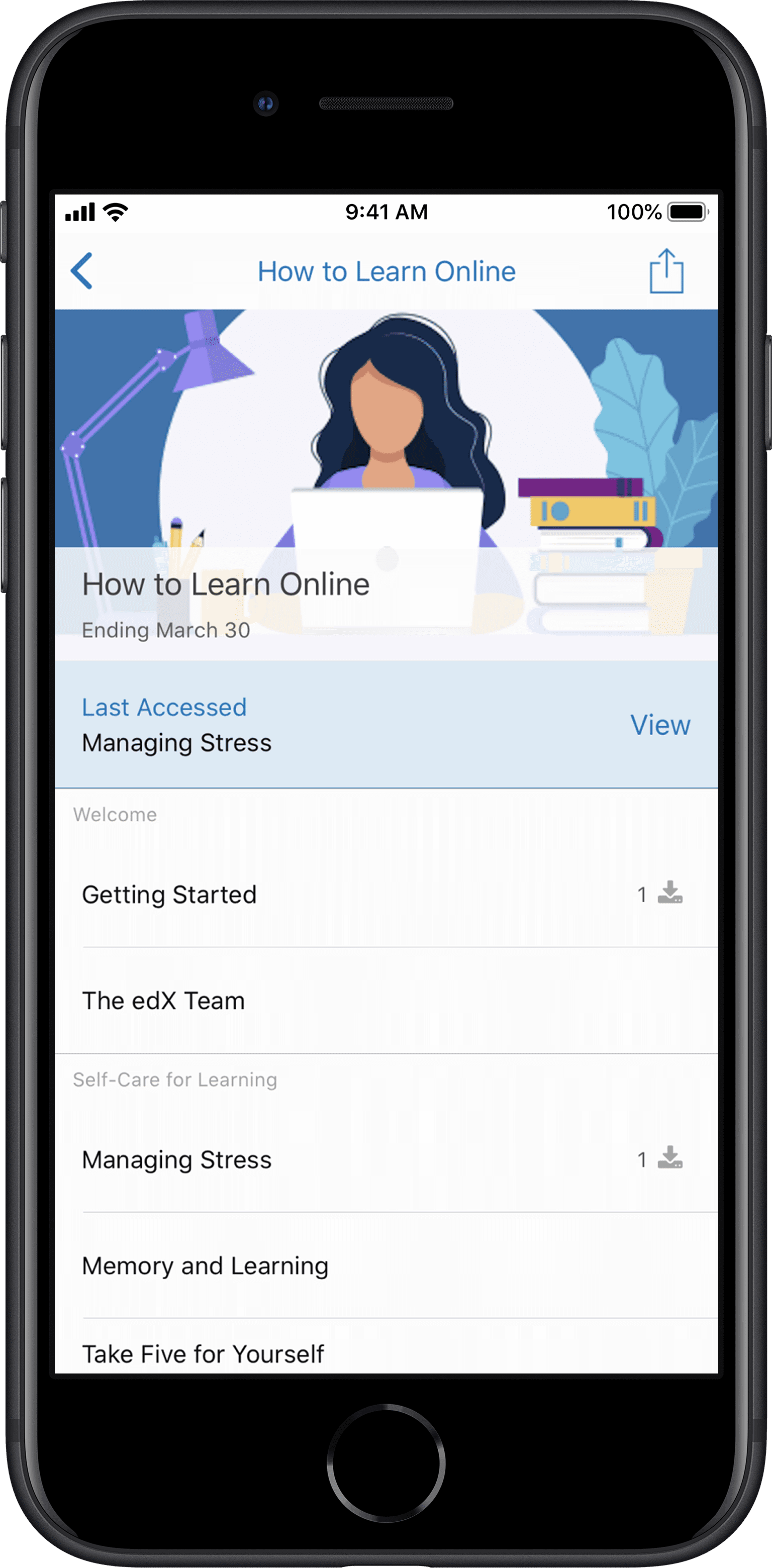

The edX platform offers courses designed in partnership with leaders in the field of finance and accounting. Students will complete courses on their own time and with a global cohort of students. Most courses are free for personal development, but students may also pursue official credit, certification, or a degree for a fee.

These courses are built for flexibility. edX's extensive collection covers many topics, including taxes, and allows students to explore for professional and personal growth.

Courses about taxes

IUx offers a professional certification in Personal Finance. This three-course series teaches about taxes as part of an overall financial strategy. Students study tax filing, federal government standards, accounting best practices, and finance tools.

Learners can also study taxes from a business perspective with NYIF's Reporting Use of Firm Resources and Taxation. The program introduces concepts such as assets, deferred taxes, and liabilities. The program also introduces basic concepts in tax law.

edX also offers courses in accounting, financial planning, and even government planning. Students can learn about the tax year, tax forms, and the details of specific tax plans. The self-employed, small businesses, and individuals can learn how to prepare for taxes.

Understanding taxes

Child tax credit. Tax refunds. Property tax. Federal and state returns. Without proper training, making even the most straightforward tax payments can be full of stress. edX offers training, allowing students to understand complex subjects.

Taxes help local governments offer programs and benefits to citizens and provides a path for the federal government to ensure the safety of everyone in the country. Taxes provide security during disruption like the pandemic and allows things like stimulus checks to happen.

A student's individual tax situation may be simple for now, but life events happen. Tax rates change, federal tax returns become more complex, and tax laws change. With the right training, learners can sort out these complexities and build a foundation of wealth that considers tax responsibility. It's real-life skills that everyone should know.